Following the 2008 financial crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted, creating the Securities and Exchange Commission (SEC) Whistleblower Program. This program offers rewards to qualified persons who provide information to the SEC which leads to the recovery of monetary sanctions, and it has grown into one of the best whistleblower programs in the country and one of the most effective checks on corporate fraud.

However, in June 2018, the SEC announced proposed amendments that would have undermined its extremely successful whistleblower program, including placing an arbitrary cap on whistleblower rewards (Rule 21F-9(e)) and creating an unrealistic reporting procedure that would disqualify a vast number of whistleblowers (Rule 21F-6).

In its advocacy to oppose potentially disastrous changes to the program, the National Whistleblower Center (NWC) campaigned heavily to urge the SEC to reverse course, speaking directly to SEC commissioners and relying on its grassroots supporters to file a record-breaking petition to protect whistleblowers.

On September 23rd, 2020, the SEC voted 3-2 to approve amendments to the rules governing the SEC’s Whistleblower Program. NWC commends the SEC for the improvements in these amendments compared to those proposed in 2018 but continues to have concerns about potential negative effects on whistleblowers.

What the New Rulemaking Means for the Program

September 2020’s rulemaking addressed four key issues:

1. Cap on the size of awards. The Dodd-Frank Act calls for 15 to 30 percent of monetary sanctions recovered to be provided to whistleblowers based on the whistleblower’s role in the success of the case. In its 2018 proposal, the SEC included a mandatory reduction in the size of awards in any case where it arbitrarily determines that the award is too large. In 2020’s rulemaking, in response to concerns from NWC and others, this mandatory reduction was removed.

2. Maximum awards in small cases. In cases where sanctions obtained by the SEC are $5 million or less, the SEC created the presumption that awards should be paid at 30 percent of monetary sanctions recovered, the highest amount. As noted by SEC Chairman Jay Clayton, most whistleblower cases result in a less than $5 million sanction, thus benefitting many whistleblowers. NWC commends the adoption of this amendment, as it will provide much-earned rewards to numerous whistleblowers.

3. Procedural barriers to securing whistleblower protection. In its 2018 proposal, the SEC included a requirement that whistleblower disclosures made to the SEC without use of the SEC’s Tip, Complaint and Referral (TCR) form be dismissed. The SEC allowed only a 30-day period after the disclosure to remedy this procedural error, an arbitrary limit which NWC and others argued was unfair to many whistleblowers with valid cases, including many whistleblowers with pending cases. In the rulemaking, the SEC indicated that the 30-day period would start only after the whistleblower learned of the TCR requirement and that it would consider exemptions from this time limit. Although this left some room for dismissals of valid cases, it largely addressed the concerns of NWC and others about not erecting unreasonable procedural barriers.

4. Related actions. Under the Dodd-Frank Act, whistleblowers are entitled to awards from the SEC for assisting with cases brought not only by the SEC but with cases brought by other agencies that stem from a disclosure to the SEC. Today’s rulemaking unfortunately raises questions about whether the SEC will fulfill its duty to pay awards for so-called related actions by other agencies. Contrary to Congress’s intent, it indicated that it may withhold such awards if they may potentially be available from other whistleblower programs. NWC will continue to advocate against such an approach, which adds costs and uncertainties to an already challenging whistleblower disclosure process.

Understanding the Value of the SEC Whistleblower Program

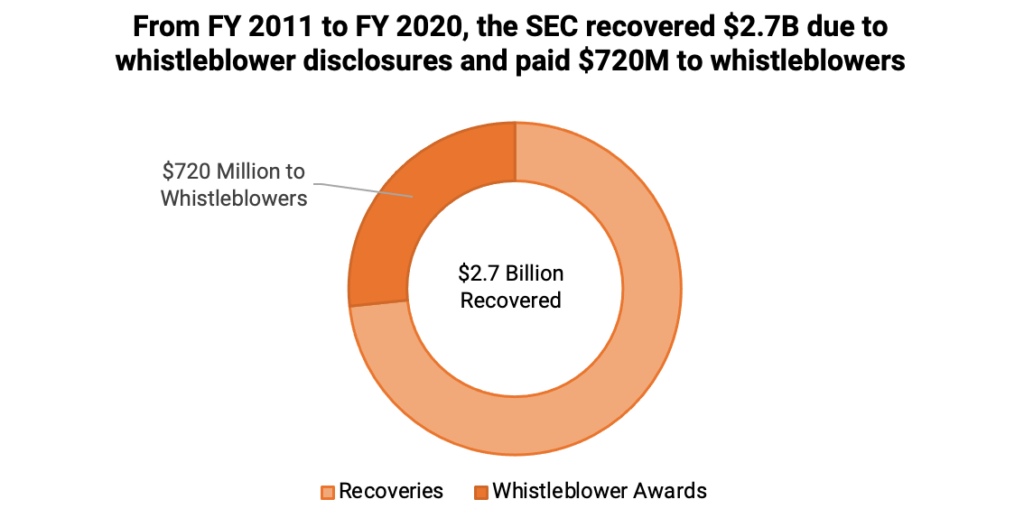

The data continues to prove the efficacy of the SEC whistleblower program. From program inception to the close of FY 2020, the SEC recovered over $2.7B from wrongdoers thanks to whistleblower disclosures and paid more than $720M to whistleblowers. In FY 2020 alone, the SEC received a record-breaking 6,900 whistleblower tips. The tips came from all 50 states as well as 78 countries outside of the United States.

The SEC’s Office of the Whistleblower’s 2017 annual report confirmed that “whistleblowers have provided tremendous value to its enforcement efforts and significantly helped investors.” It also confirmed that SEC whistleblower disclosures have “directly” contributed to “hundreds of millions of dollars returned to investors.” For example, that year alone the SEC paid $50 million in whistleblower rewards to 12 individuals.

Leadership of the SEC agree that whistleblower information is crucial for the success and ability of the SEC enforcement capacities. Time and time again, the SEC has made it clear: whistleblowers should not hesitate to come forward with information that they believe may lead the SEC to discover and prosecute criminals who aim to evade and undermine U.S. laws.

Former SEC Chairman Mary Jo White commented in 2013, “The whistleblower program . . . has rapidly become a tremendously effective force-multiplier, generating high quality tips, and in some cases virtual blueprints laying out an entire enterprise, directing us to the heart of the alleged fraud.”

Not only are such corporate whistleblower programs force multipliers, but they also enjoy broad public support. A Whistleblower News Network poll released in October 2020 shows that the American public considers corporate fraud a national priority and wants to help whistleblowers who expose it.

When asked if passing stronger laws that protect employees who report corporate fraud should be a priority for Congress, 82 percent of those surveyed agreed, with 29 percent stating that it should be an immediate priority. This poll should provide Congress with all the encouragement it needs to act on pending whistleblower bills addressing private sector corruption, like the Whistleblower Programs Improvement Act, which would strengthen the SEC program.