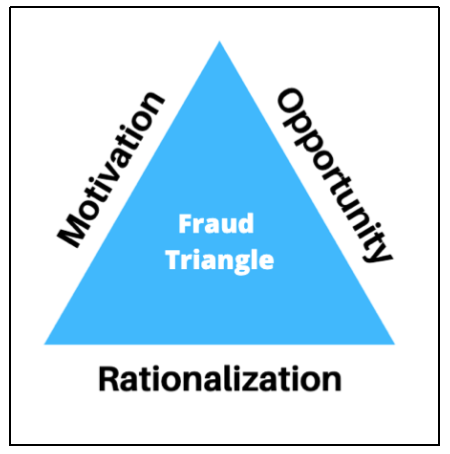

To predict the conditions that lead to a high risk of fraud, anti-fraud professionals and researchers frequently rely on a concept called the “fraud triangle.” Drawing on criminological research from Edwin Sutherland and Donald R. Cressey, Steve Albrecht coined the term to model conditions that lead to a higher risk of fraud. According to Albrecht, the fraud triangle states that “individuals are motivated to commit fraud when three elements come together: (1) some kind of perceived pressure, (2) some perceived opportunity, and (3) some way to rationalize the fraud as not being inconsistent with one’s values.”

Today, the fraud triangle is widely used by anti-fraud professionals to explain conditions that could motivate individuals or companies to engage in fraud. The model can also be used to highlight economic or industry-wide conditions that can lead to a higher overall risk. To identify risk, anti-fraud professionals look for the presence of the following three factors:

- Motivation

- Opportunity

- Rationalization

Motive

To identify motivations, researchers and anti-fraud professionals typically search for financial pressure or incentives. Pressure can to engage in fraud can be high, for example, when organizations or employees feel pressure to meet financial targets, to catch up to competitors, or to make up for poor past performance. Economic condition such as a financial crisis can make pressure particularly acute, increasing the temptation for fraud. To identify incentives that are conducive to fraud, researchers look at the relationship between structural incentives, such as executive compensation structures, and incentives to engage in fraud.

Opportunity

Opportunities for fraud are high when fraud goes undetected. To identify opportunities for fraud, researchers and consultants commonly point to internal structural factors including internal controls or auditing procedures. Economic conditions such as a financial crisis may also increase opportunities. For example, opportunity could be greater at a companies who has recently laid off employees, making it harder to maintain a segregation of duties, an important factor for fraud prevention. To identify opportunities, researchers also look to regulatory oversight, which can affect the risk calculation of employees who are tempted to commit fraud.

Rationalization

When opportunities to commit fraud exist alongside motivation, the fraud triangle suggests that a third, necessary component for fraud is the ability for employees to justify fraud. Employees may have an easy time rationalizing fraud, for example, when they perceive that executives condone fraud or believe that fraud is widespread across an industry. Anti-fraud professionals also look to economic factors that can be used to rationalize fraud, such as the belief that fraud is necessary to help a business survive a financial crisis.

As the research of Sutherland and Cressey pointed out, even individual acts of fraud are rarely the direct result of inherent personal traits, but rather are highly influenced by conditional environmental factors. The fraud triangle is therefore an important conceptual tool for highlighting environments that are conducive to fraud. By identifying instances in which there is is significant pressure or incentive to commit fraud, unusual opportunities for fraud to go undetected, and where employees can rationalize their behavior, researchers and anti-fraud professionals can identify companies, industries, and economic conditions that are particularly conducive to corruption.