Climate change is introducing new business risks and financial challenges for industries engaged in fossil fuel extraction and deforestation, as well as financial institutions and other professional enablers that support them. As companies in these industries face increasing pressure, new regulations, and additional oversight, some may turn to corruption or fraud to meet unrealistic expectations or avoid accountability.

Executives under pressure could be tempted to conceal climate risks from investors, overstate the value of their fossil fuel assets, or understate their environmental liabilities. Fossil fuel and forest-risk commodity companies could also maintain an unfair advantage around the world by engaging in bribery, money laundering, or tax evasion.

Whistleblowers could play an important role in revealing complex schemes designed to help companies evade scrutiny or maintain an unfair advantage. A climate change whistleblower is a person who discloses information about violations of law, gross mismanagement of funds, abuse of authority or other wrongdoing that exacerbates climate change. As with all other whistleblowers, climate change whistleblowers possess information about wrongdoing not generally known by the public and disclose this information (typically to a government official, journalist or employer) for the purpose of rectifying the wrongdoing.

In the case of climate change whistleblowers, rectifying the wrongdoing could include reducing threats to the economy and global financial stability posed by climate change risks, as well as abating further damage to the environment and public health. In order to report climate-related crimes, these whistleblowers will need to rely on whistleblower laws that provide strong protections and several strong whistleblower laws also offer financial rewards. Currently, there are several powerful U.S. whistleblower laws can protect and reward whistleblowers who report fraud or corruption that enables the climate crisis.

Laws that Protect and Reward Climate Change Whistleblowers

U.S. laws are uniquely well-suited for enlisting people around the world to help fight financial fraud that fuels the climate crisis. There have been a host of laws enacted by the U.S. Congress and the states in the past few decades that encourage whistleblowers to report financial fraud to authorities. The best of these laws allow whistleblowers to report crimes without revealing their identity and to receive a financial reward for contributing to a successful prosecution.

False Claims Act

The federal and state False Claims Acts require accurate representations by private companies transacting business with the U.S. government, such as companies receiving funds from the U.S. Department of Energy. The False Claims Act also addresses reverse false claims, in which the government is prevented from collecting what it is owed, such as oil and gas royalties or customs duties on tropical timber.

Under these laws, whistleblowers can file a qui tam lawsuit on the government’s behalf and collect a share of the government’s recovery. Whistleblowers are eligible for between 15% and 30% of the monetary sanctions. These rewards are often substantial, since under the False Claims Act, the criminal is liable for a civil penalty as well as treble damages.

Foreign Corrupt Practices Act

Whistleblowers with knowledge of bribery, such as bribes made to obtain oil & gas or mining contracts or permits, can also use the Foreign Corrupt Practices Act (FCPA) to report to the SEC. The FCPA prohibits thousands of corporations, both U.S. and international, from paying bribes to foreign officials and mandates proper financial record keeping. The FCPA is extremely broad in scope and applicable worldwide; whistleblowers can report on issuers and their subsidiaries and personnel, as well as foreign entities and agents. The FCPA allows whistleblowers, including foreign nationals, to file claims anonymously, reducing the risk of retaliation.

Dodd Frank Act

Whistleblowers can use the Dodd-Frank Act to report securities or commodities fraud, including undisclosed material climate risks or attempts to manipulate oil and gas prices. Passed in 2010, the Dodd-Frank Act created whistleblower offices at the Securities and Exchange Commission (SEC) and Commodities Futures Trading Commission (CFTC). Whistleblowers, including foreign nationals, can now report securities or commodities fraud while keeping their identity confidential. Whistleblowers can report any company that violates U.S. federal securities laws, regardless of the location of the company’s headquarters or operations.

Whistleblowers who provide original information to the SEC or CFTC about securities fraud, commodities fraud or violations of the FCPA that leads to a successful prosecution are eligible for a financial reward between 10% and 30% of monetary sanctions that exceed USD$1 million.

IRS Whistleblower Law

Whistleblowers with evidence of tax evasion or money laundering can use the Internal Revenue Service (IRS) whistleblower law to report to the IRS. IRS whistleblower claims can be filed by any individual with credible information concerning major tax fraud, including outside contractors. The IRS offers discretionary awards for small tax cases, and the IRS is required to give eligible whistleblowers 15% to 30% of the amount recovered from successful prosecutions when the proceeds in dispute exceed USD$2 million or when the case is filed against an individual whose income exceeds USD$200,000.

Additional Laws

Whistleblowers can also use additional industry-specific laws, such as the Act to Prevent Pollution on Ships, which protects and rewards shipping pollution whistleblowers or the the Lacey Act, which protects and rewards whistleblowers who report the illegal timber trade. Banking and finance whistleblowers can also use the Financial Institutions Reform Recovery and Enforcement Act, which protects and rewards whistleblowers who report legal violations at banks and other depository institutions.

In addition to laws that provide strong financial rewards, there are additional laws that protect whistleblowers from retaliation, such as the Sarbanes-Oxley Act, which provides protection for whistleblowers who report a violation of federal securities law, SEC rules, or any federal law related to fraud against shareholders. This law protects employees of publicly traded companies and contractors, subcontractors, and agencies of publicly traded companies, including auditors and accountants. If a whistleblower’s retaliation claim prevails, they can be entitled to back pay, reinstatement, and special damages.

Blowing the Whistle in the Oil & Gas Industry

Oil and gas industry whistleblowers have been instrumental in revealing environmental damage and corruption in the oil and gas industry, including the coverup of toxic waste in Ecuador, fraudulent reserves reporting schemes, and fraudulent royalty underpayment schemes. Using powerful U.S. whistleblower laws, whistleblowers can continue to help detect and prosecute fraud and corruption – while protecting their identity and qualifying for a reward.

The Dodd-Frank Act provides a strong avenue for whistleblowers to report securities and commodities fraud in the oil and gas industry. In July 2020, the National Whistleblower Center published a report, Exposing the Ticking Time Bomb, which highlighted several types of fraud companies could engage in to avoid disclosing climate-related risks to investors. If oil and gas companies inflate their reserves, attempt to hide environmental liabilities, fail to disclose material climate risks, or otherwise mislead investors, employees can confidentially report this to the SEC.

Oil and gas whistleblowers with knowledge of fraud against federal programs or contracts can also use the powerful qui tam provision of the False Claims Act to report fraud by companies receiving funds from the U.S. Department of Energy. Whistleblowers could report fraud reverse false claims act violations, such as the failure to properly pay oil and gas royalties.

Using the False Claims Act, whistleblowers can also report companies who misrepresent their safety or emergency response preparedness to the government. A previous False Claims Act investigation of BP after the Deepwater Horizon disaster shows how companies could be held accountable for violating the False Claims Act when they lie about emergency preparedness on leasing applications.

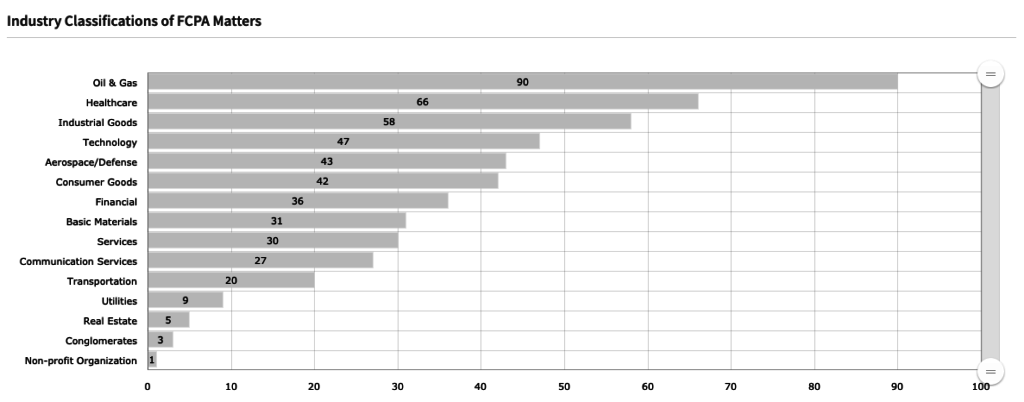

Oil and gas whistleblowers can also use the Foreign Corrupt Practices Act to report corruption that greases the wheels for the oil and gas industry around the globe. Bribery in the oil and gas industry has allowed companies to obtain contracts and permits, gain an advantage over other industries, avoid paying taxes and customs duties, and avoid accountability for other legal violations. The oil and gas industry has the highest number of Foreign Corrupt Practices Act enforcement actions of any industry, with a total of 46 groups of related enforcement actions.

To become global powers, oil and gas majors have also built a complex web of shell companies in tax havens, allowing them to design tax structures that shift and maximize profits, often at the expense of taxpayers around the world. While losses for taxpayers have been well-documented and major oil and gas companies are frequently accused of legally questionable practices, actual violations of tax laws have often been difficult to prove. Through the IRS whistleblower program, oil and gas whistleblowers could reveal tax evasion practices that allow oil and gas companies to extract wealth around the world without paying their fair share.

Source: Stanford Law School, Securities Class Action Clearinghouse

Blowing the Whistle on the Coal Industry

Whistleblowers in the coal industry have revealed numerous scandals, such as schemes designed to evade safety regulations or to inflate the value of coal. As the coal industry faces a long and ugly decline, whistleblowers around the world could use several strong U.S. whistleblower programs to report attempts to fraudulently extend the life of the coal industry.

The Dodd-Frank Act allows coal industry whistleblowers to report securities and commodities fraud, including undisclosed material climate risks. As the energy transition creates added pressure on a financially challenged industry, executives might be particularly tempted to engage to fraudulently inflate the quantity or quality of the company’s coal. To get rid of burdensome environmental rehabilitation obligations, companies may also understate environmental liabilities before spinning them off or shedding them in bankruptcy.

As investors become increasingly concerned with environmental impacts and climate risks, companies could conceal material climate risks from investors. With greater interest in clean coal or carbon capture technology, companies could take advantage of enthusiastic investors by making unrealistic claims about their technological innovations. Whistleblowers can report each of these types of fraud through the SEC whistleblower program.

Coal industry whistleblowers around the world can also use the Foreign Corrupt Practices Act to report attempts to use bribery to maintain contracts or permits or to avoid scrutiny. As coal mining and coal power companies face increasing competition from more cost-effective renewable energy, some executives may be tempted to protect investments or hide evidence of other fraud by bribing politicians, regulators, or companies in their supply chain. Whistleblowers, including contractors, can report this while protecting their identity and qualifying for a reward.

Blowing the Whistle on Timber and Forest-Risk Commodity Companies

Individuals with knowledge of illegal activity in the timber and forest-risk commodity industries often face significant obstacles to reporting, including corrupt local law enforcement and the threat of violent retaliation. However, whistleblowers around the world can use powerful U.S. whistleblower laws to report confidentially or even anonymously.

To protect forests from illegal logging, whistleblowers can use the False Claims Act and the Lacey Act to report mislabeled timber that is imported into the U.S. “Reverse false claims” apply to customs violations including false statements such as the undervaluation and/or misclassification of goods entering the U.S. A 2008 amendment to the Lacey Act banned the importing, exporting, buying, and selling of illegally sourced plants, and requires companies trading in most wood products to submit formal declarations of the species and origin of harvest.

Using the Dodd-Frank Act, whistleblowers can also report companies that mislead investors about sustainability risks or misreport their natural capital. Investors are increasingly recognizing deforestation as an environmental and financial risk, and misleading claims have previously snowballed into serious financial scandals. If companies fail to address increasing deforestation risks tied to their business, misleading consumers or investors in the process, whistleblowers could play a role in revealing these hidden risks.

Whistleblowers could use the Foreign Corrupt Practices Act to report corruption that fuels the illegal timber trade through bribes for forest permits, the use of escorts to evade checkpoints, the forging of official documents, and the retrospective issuance permits. If companies engage in money laundering to hide ill-gotten gains from illegal activities, whistleblowers could use the IRS whistleblower program report them, along with the third parties who facilitate these transactions, such as real estate companies or financial institutions.

Blowing the Whistle on Professional Enablers

While fossil fuel extraction and deforestation are the activities most responsible for climate change, most of the companies in these industries could not operate without support from financial institutions and other professional services. These can include banks and other financial institutions, insurance companies, auditing and accounting firms, credit rating agencies, public relations firms, and other consulting agencies.

By providing key services to the companies involved in fossil fuel extraction and deforestation, these companies enable climate change. Through willful, complicit, or negligent conduct, these groups can also serve as professional enablers of climate-related financial crimes. However, whistleblowers from these groups can rely on several powerful U.S. whistleblower laws to report corruption or other wrongdoing.

Banks and Other Financial Institutions

The Dodd-Frank Act allows whistleblowers to report a wide range of actors for securities fraud, including publicly listed financial institutions. If banks or other financial institutions mislead investors about exposure in their loan portfolios to material climate-related risk or make false statements about material climate-related risks of asset-backed or mortgage-backed securities, whistleblowers can confidentially or anonymously report to the SEC.

The False Claims Act, which addresses false claims made to the government, could also be a powerful tool for whistleblowers from financial institutions with knowledge of false claims made in relation to mortgages and loans affected by physical climate risks. After the financial crisis, several whistleblowers successfully used the False Claims Act to file qui tam complaints against banks that led to billion-dollar settlements. The complaints reported false claims in connection with underwriting, origination and quality control of residential mortgages that banks sold to Fannie Mae and Freddie Mac, as well as loans insured by the Federal Housing Administration.

As physical climate risks threaten low-lying areas, banks are rapidly shifting mortgages in flood-prone areas to Fannie Mae and Freddie Mac. If banks make false claims about risk in relation to those mortgages, whistleblowers could use the False Claims Act to report it.

Another bank whistleblowing law, the Financial Institutions Reform Recovery and Enforcement Act (FIRREA), could help whistleblowers report a wide range of legal violations at banks and other depository institutions, including fraud related to understated risks in asset-backed securities. In 2017, Volkswagen’s USD 50 million settlement for the Dieselgate scandal resolved alleged violations of FIRREA related to claims about emissions testing. According to the settlement, false claims about the emissions tests inflated the value of vehicles that served as collateral for loans and leases. These loans and leases were pooled together to create asset-backed securities, and federally insured financial institutions purchased notes in these securities.

The IRS whistleblower program and the Anti-Money Laundering Act could also help banking employees report money laundering and illicit financial flows that fuel the climate crisis. In 2020, the International Consortium for Investigative Journalists (ICIJ) revealed in the FinCEN files that, in the past twenty years, global banks have knowingly moved trillions of dollars in payments they knew were suspicious, even after being fined by U.S. authorities for earlier failures to stop these transactions. By failing to flag or by facilitating suspicious financial transactions, banks could further fuel the climate crisis by disguising the proceeds of illegal logging or hiding evidence of bribery in corrupt oil deals.

Professional enablers also play a key role in facilitating corruption that accelerates illegal deforestation and unsustainable fossil fuel extraction, as more than 90% of Foreign Corrupt Practices Act enforcement actions involve on a third-party intermediary. Whistleblowers around the world can use the Foreign Corrupt Practices Act to report bribery or the failure to maintain adequate internal controls at thousands of corporations, both U.S. and international.

Auditing and Accounting Firms

Auditors and accountants also play an important gatekeeping role in the financial system. As climate-related financial risks grow, auditing and accounting companies unable or unwilling to spot new climate-related risks could protect the industries driving climate change from financial consequences and leave investors in the dark about climate and sustainability risks.

Auditing and accounting whistleblowers may have knowledge about climate-related fraud by their employers or their clients, such as overstated fossil fuel assets or palm oil plantations. While the SEC generally excludes auditors and accountants from becoming whistleblowers, there are several key exceptions that allow both internal and external auditors and accountants with knowledge of securities fraud to qualify as whistleblowers.

Research shows that higher corporate climate risks are associated with a higher use of tax havens, which is often enabled by intermediaries. In 2018, the Financial Action Task Force examined 106 cases of money laundering and tax evasion and found professional intermediaries played a key role in the majority of the cases. To report tax evasion, accountants and other whistleblowers can also use the IRS whistleblower program.